Income Tax Brackets 2020 : Tax Brackets for 2020, 2021 and 2022. Caldculate Tax Rates / In the tables below, it is important to note that the highlighted rates represent the income tax rate owed for the portion of your taxable income that falls into that bracket.

Income Tax Brackets 2020 : Tax Brackets for 2020, 2021 and 2022. Caldculate Tax Rates / In the tables below, it is important to note that the highlighted rates represent the income tax rate owed for the portion of your taxable income that falls into that bracket.. Single, married filing jointly or qualifying widow(er), married filing separately, and head of household. $51,667 plus 45c for each $1 over $180,000. The irs on wednesday released the updated tax brackets for the 2020 filing season, which have been modified to keep pace with inflation. Federal income tax brackets are adjusted every year for inflation. The more tax you will be paying.

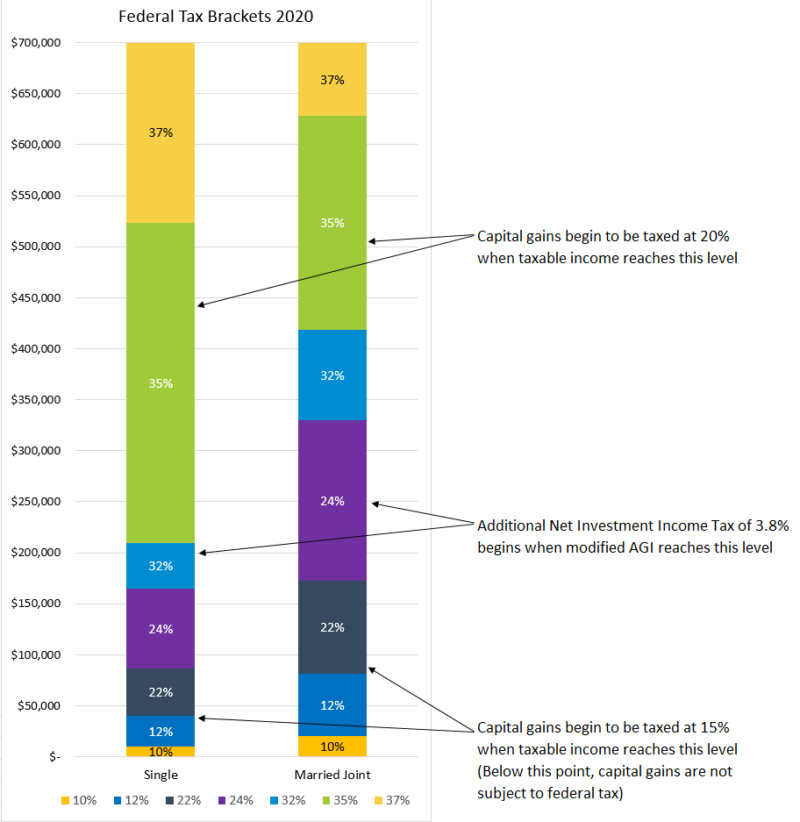

Has a progressive tax system, meaning the higher your taxable income, the higher your tax rate. The 2020 tax brackets (and how they changed in 2021). Each year, the irs typically changes tax brackets slightly. Use the new rateucator below to get your personal tax bracket results for tax years 2020 and 2021. At the federal level, there are seven tax brackets that range from 10% to 37%.

Federal income tax brackets are determined by income and filing status.

Use the new rateucator below to get your personal tax bracket results for tax years 2020 and 2021. Can i deduct my entire income tax for 2020? In the tables below, it is important to note that the highlighted rates represent the income tax rate owed for the portion of your taxable income that falls into that bracket. $0 + $280 = $280. Here are the tax brackets for tax years 2020 and 2021, and how you can work out which tax bracket you fit into. Dollar amounts represent taxable income earned in 2020 $51,667 plus 45c for each $1 over $180,000. However, it's important to understand that your entire income is not taxed at back to top. The more you make, the more you pay. The 2020 filing season refers to taxes that need to be filed in april 2021. The federal tax brackets are progressive. Marginal tax brackets tax tables for tax year 2020 an individual's tax liability gradually increases as their income increases. What has changed for 2021—so, for the taxes you'll file in 2022—are the income ranges.

Below are the tax rates for the 2021 filing season for three common filing statuses. $0 + $280 = $280. Use our us tax brackets calculator in order to discover both your tax liability and your tax rates for the current tax season. 2020 federal tax brackets with each bracket's marginal tax rate, based on a taxpayer's taxable income. At the federal level, there are seven tax brackets that range from 10% to 37%.

The irs released the federal tax rates and income brackets for 2020 on wednesday.

If you're a single filer and your 2021 taxable income is $55,000, $9,950 is taxed at 10%. At the federal level, there are seven tax brackets that range from 10% to 37%. Comparing 2020 and 2021 federal tax brackets and rates. In the tables below, it is important to note that the highlighted rates represent the income tax rate owed for the portion of your taxable income that falls into that bracket. Your tax rate depends on your which tax bracket you are in. The more income you receive; 2020 tax brackets (irs federal income tax rates table). The irs on wednesday released the updated tax brackets for the 2020 filing season, which have been modified to keep pace with inflation. Marginal tax brackets tax tables for tax year 2020 an individual's tax liability gradually increases as their income increases. For example, the 22% tax bracket for the 2020 tax year goes from $40,126 to $85 how the tax brackets work. 2020 federal tax brackets with each bracket's marginal tax rate, based on a taxpayer's taxable income. Which federal income tax bracket are you in? Since $90,000 is in the 24% bracket for singles, would.

Comparing 2020 and 2021 federal tax brackets and rates. What has changed for 2021—so, for the taxes you'll file in 2022—are the income ranges. For income earned in 2020, the following are the brackets at which each segment of your applicable income are taxed The 2020 tax brackets (and how they changed in 2021). The tax cuts announced in the october 2020 federal budget mean that many taxpayers will receive a bigger tax offset when they put in their return.

Here is the breakdown for taxes due in april 2022, which will be paid for income as reference, here are the federal tax brackets for taxes that were due in april 2020, for your income earned in 2019.

Use our us tax brackets calculator in order to discover both your tax liability and your tax rates for the current tax season. Dollar amounts represent taxable income earned in 2020 See how tax brackets work & how to cut your taxes. Federal income tax brackets are adjusted every year for inflation. How many federal tax brackets are there? Has a progressive tax system, meaning the higher your taxable income, the higher your tax rate. Federal tax brackets & rates for 2020 & 2021. State income tax probably works out in a similar fashion, though the exact number will depend on your state and how they've set up deductions and brackets. Suppose you're single and have $90,000 of taxable income in 2020. Your tax rate depends on your which tax bracket you are in. In the american tax system, income taxes are graduated, so you pay different rates on different amounts of taxable income, called tax brackets. The 2020 filing season refers to taxes that need to be filed in april 2021. Tax brackets generally change every year, and the brackets for 2020 income taxes (those filed by april 2021) have been released.

Komentar

Posting Komentar